Withholding Taxes

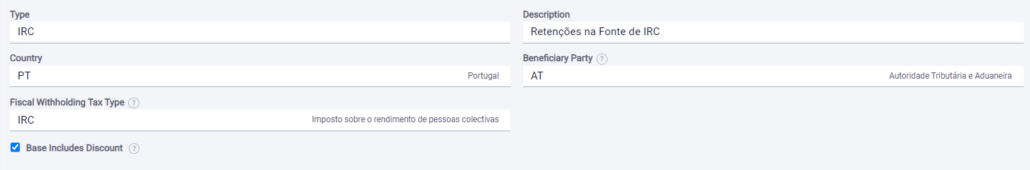

The tax withholding is the way in which the State collects part of the payable due by tax payers amount in advance. A representative example is the IRS (Personal Income Tax). The State generally imposes this type of withholdings to avoid the accumulation of tax due throughout the year, to avoid non-payment of taxes. The withheld tax must be paid for the service provided by the entity (in most cases, individual service providers), and is deducted when the customer makes the payment. This means that the issued invoice can specify the value being withheld by the customer, without affecting the invoice total amount. If the document being used is the Cash Invoice, the withheld amount will affect the total being received by the service provider. To specify the withholding on the issued documents, you must associate to the customer the applicable withholding scheme and the correct withholding rate for the services provided. To setup the withholdings in sales, follow these steps: Access the entity file in Customers and Items | Customers and on the tab Customer associate the Item WHT Schema (configured on step 2). After performing the association, every time you issue a document to the set up customer, the withholding will be performed on the items with the corresponding rates. Tax withholding is a Portuguese fiscal measure that works as an advance payment or as a payment in installments of taxes owed to the State. The IRC Tax Withholding is automatically setup by the system. However, it is possible to manually set up the new withholding types. To setup new withholding types, follow these steps: Customers Note: If you wish that all customers have this scheme associated, you can mark this option as default. For that, access Setup | Documents | Customer Groups, select the default groups and on the field Party Withholding Tax Schema select IRC. ItemsLegal framework

Setting up withholdings

Step 4: Associating the withholding tax schema to the customer

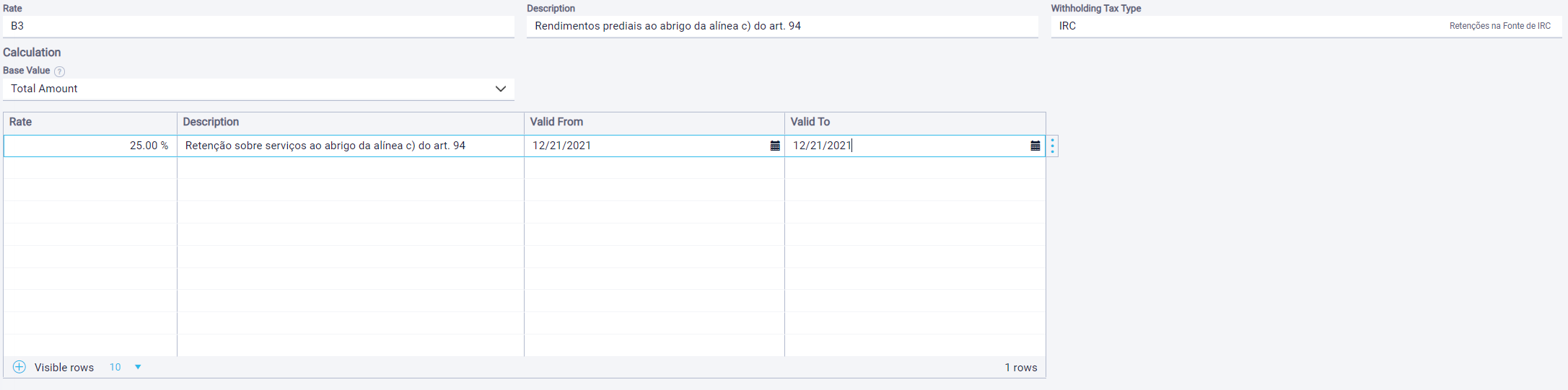

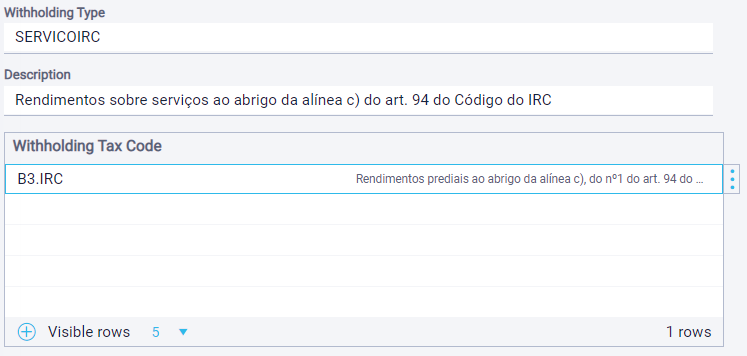

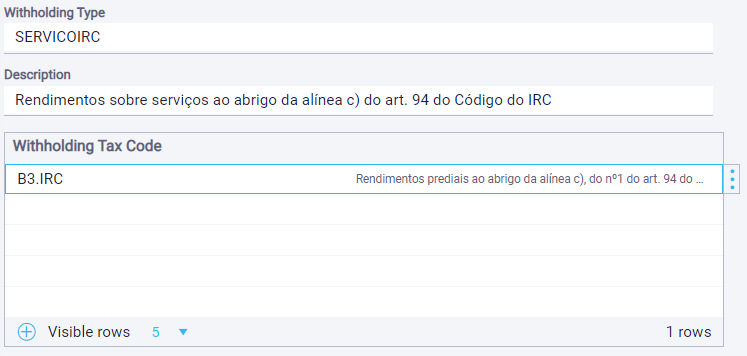

Manually configuring new withholding tax types

Step 1: Creating the Withholding Type

Step 2: Creating the Withholding Code

Step 3: Creating the Item Withholding Schema:

Step 4: Creating the Party Withholding Schemas

Step 5: Associating the Customer and Item Withholding Schema